🤖 27 Reddit communities to start with, 5 fatal fundraising mistakes, and why Europe lacks its own Google

s4e1. Only useful and interesting information for the development of your startup ❤️

Greetings, tireless entrepreneurs and builders of the future! Today we will talk about how to launch your startup via Reddit, discuss the most common fatal mistakes in fundraising, and gain valuable insights from recent reports. We will also take a look at why, according to Meta, Europe still does not have trillion-dollar mega-corporations. We will finish our info tour with a brief overview of the challenges and opportunities faced by the legendary fund Sequoia Capital.

1. Startup development: 27 subreddits to launch your startup

Viktor Bigfield, in his X (formerly Twitter) post, compiled a list of 27 subreddits for launching startups. It might seem that Reddit is just forums and commenting, but the key is finding the right subreddits to showcase your product or service. If you are looking for a non-trivial way to reach a foreign audience or simply want to generate an initial flow of interested users, these 27 communities can be an excellent starting point.

Reddit values openness and sincerity, so never try blatant self-promotion without providing additional benefits for the community members. Remember the simple rule: give value first, then promote your product.

https://x.com/victor_bigfield/status/1847247427297858031

2 VC: 5 fundraising tips most founders ignore.

Oleksiy Yermolenko, co-founder and partner of the venture fund F1V, shared an interesting piece about fundraising. He notes that it is always a difficult, resource-intensive, and very emotional task for founders, yet it has to be done. Here are a few key ideas from his article:

“Fundraising is a full-time job,” but founders must continue building their product at the same time. Those who manage to combine both processes have innate multitasking skills.

“Treat fundraising like a sales funnel.” The author emphasizes that it is a B2B sale of a stake in your company. Always keep a tracker of potential investors and understand that the conversion rate can be very low — only 2%.

“80% of sales occur on the fifth attempt.” There is nothing wrong with politely and persistently reminding investors about yourself.

“Start with less relevant funds and gather feedback.” This will allow you to refine your pitch, anticipate questions, and improve your product or business model.

“Raise enough for 1.5-2 years.” This is especially important in tough market conditions, when short bridge rounds can be too risky.

Oleksiy advises reading the book “The Great CEO Within: The Tactical Guide to Company Building” and listening to the “20VC” podcast to better understand the nuances of fundraising.

https://www.linkedin.com/pulse/5-vital-fundraising-tips-most-founders-ignore-flyer-one-vc-bekdf/

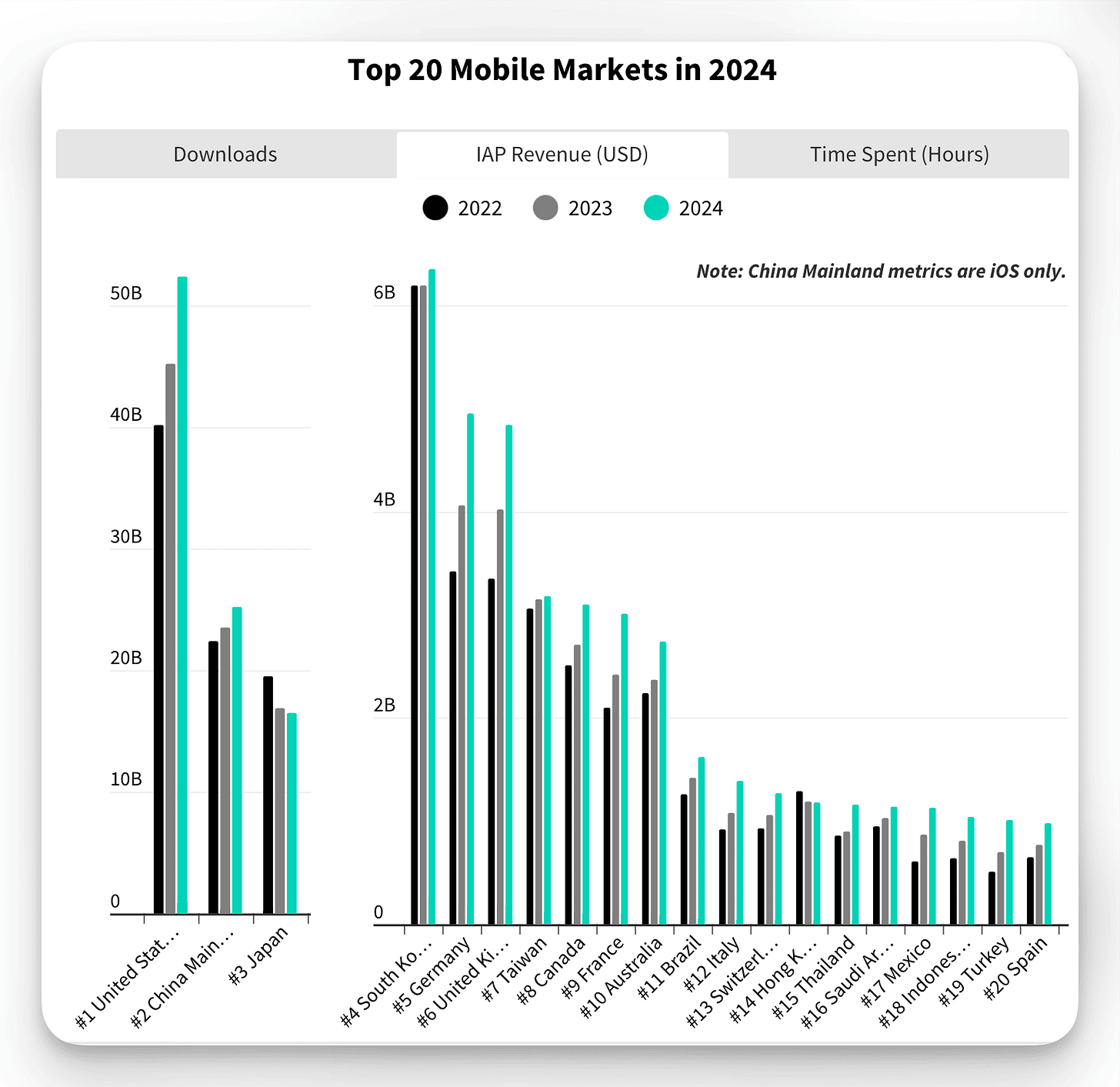

3. Data: 150 billion dollars in mobile and the AI app boom.

According to the Sensor Tower “2025 State of Mobile” report, global user spending on apps (IAP, paid apps, games) in 2024 reached 150 billion dollars, 13% more than the previous year, which is the highest growth rate since 2021.

The report highlights several key points:

“Consumers spent 4.2 trillion hours across iOS and Google Play apps,” or about 3.5 hours per day per user. However, in some developed markets, digital fatigue is setting in, slowing the growth of time spent in apps.

“Mobile gaming bounced back to 81 billion dollars (+4% YoY) after two years of decline.” This rebound is driven by more stable monetization and improved game mechanics.

“AI apps are already a billion-dollar industry, with IAP revenue in AI chatbot and AI art generator apps approaching 1.3 billion dollars in 2024.” In 2025, the trend of growing non-gaming apps is expected to continue, particularly those that use AI to improve the user experience (such as Duolingo or Strava).

These data points show that the mobile market is still full of opportunities, especially if you catch the relevant wave — for example, AI functionality or a hybrid format (mix of an app and an offline experience).

4. Opinion: Why Europe has no trillion-dollar tech giant — the view of Meta’s Head of AI.

Yann LeCun, Meta’s chief AI specialist, shared his thoughts on why Europe has not yet produced any technology company worth a trillion dollars. He believes the lack of large-scale labs for fundamental research in European corporations is one of the key reasons.

In an article in The Decoder, it is noted: “Almost all fundamental AI innovations of the past twelve years came not from startups, but from well-funded research labs of large technology companies.”

LeCun points to the example of DeepMind, acquired by Google for around 440 million euros, which is now a leader in AI. In his view, without Google’s support, that company would have hardly survived on its own, since developing such research requires significant funding and long time horizons.

The article also states: “Europe must stop selling its most valuable companies to US corporations... It needs more experienced founders who finance risky but important technologies.” Thus, expanding powerful R&D departments in European firms and braver venture financing may spur the emergence of trillion-dollar companies on the continent.

5. Video: Sequoia Capital under global challenges — will the legend stand strong?

I conclude today’s newsletter on that note. Remember that the right combination of non-trivial Reddit communities, the ability to conduct effective fundraising, a thorough analysis of market reports, and attention to global trends will help you stand out in the fast pace of modern business.

Until next time!