🍛 How the 80/20 Rule Can Help Your Startup, the IPO Boom in India, and Why YouTube Is Consuming Podcasting

s3e10. There is more to read for every day

Greetings, tireless entrepreneurs and innovators! Today we will explore how to apply the 80/20 principle in your startup, learn about the upcoming IPO boom in India, and examine how YouTube is changing podcasting. Get ready for a dose of valuable information that will help you stay one step ahead.

1. Startup Development: The 80/20 Principle for Founders

Greg Isenberg, a well-known entrepreneur and investor, raised an important topic for startup founders in his Twitter post: applying the 80/20 principle, also known as the Pareto principle. He argues that focusing on the key 80% aspects can significantly impact your business's success.

He provides specific examples of how this principle applies in different areas of a startup:

Traction: "80% distribution, 20% product". This means founders should pay more attention to how their product is distributed and reaches users than to the product's features themselves.

Growth: "80% retention, 20% acquisition". Retaining existing customers is more important than acquiring new ones.

Revenue: "80% existing customers, 20% new leads". Most income comes from current customers.

Pricing experiments: "80% positioning tweaks, 20% actual price changes". Small changes in positioning can have a bigger impact than changing the price.

Brand building: "80% customer experience, 20% logo design". Customer satisfaction is more important than visual brand elements.

Other examples:

Sales: "80% listening, 20% pitching". Listen to customers' needs more than you try to sell.

Community building: "80% empowering users, 20% company-led initiatives".

Product: "80% core features, 20% nice-to-haves".

Time: "80% executing, 20% strategizing".

Isenberg concludes: "Prioritize the 80% that moves the needle. The rest is just noise."

This principle urges founders to focus on the most important aspects of the business that bring the most results. Think about how you can apply the 80/20 rule in your startup. Which 20% of efforts bring you 80% of results? Perhaps it's worth revising your priorities and focusing on what really matters.

https://x.com/gregisenberg/status/1847987457301561664

2. VC: India Prepares for a Big IPO Surge in 2025

According to TechCrunch, India stands out in the global initial public offering (IPO) market this year, becoming a rare bright spot for tech listings while other major markets face difficulties. India, as the world's most populous country, is preparing for an even larger wave of startup IPOs in 2025.

According to multiple sources, over 20 startups are preparing to go public next year. Among them:

Inframarket and Zetwerk — B2B marketplaces.

CaptainFresh — farm-to-table fresh produce supplier.

UrbanCompany — professional services marketplace.

Bluestone — jewelry retailer.

OneAssist — security company.

Magicpin — offline-to-online retailer.

Other companies planning to file for IPO next year:

Zepto — quick delivery startup.

Table Space — workspace provider.

Ofbusiness — industrial goods platform.

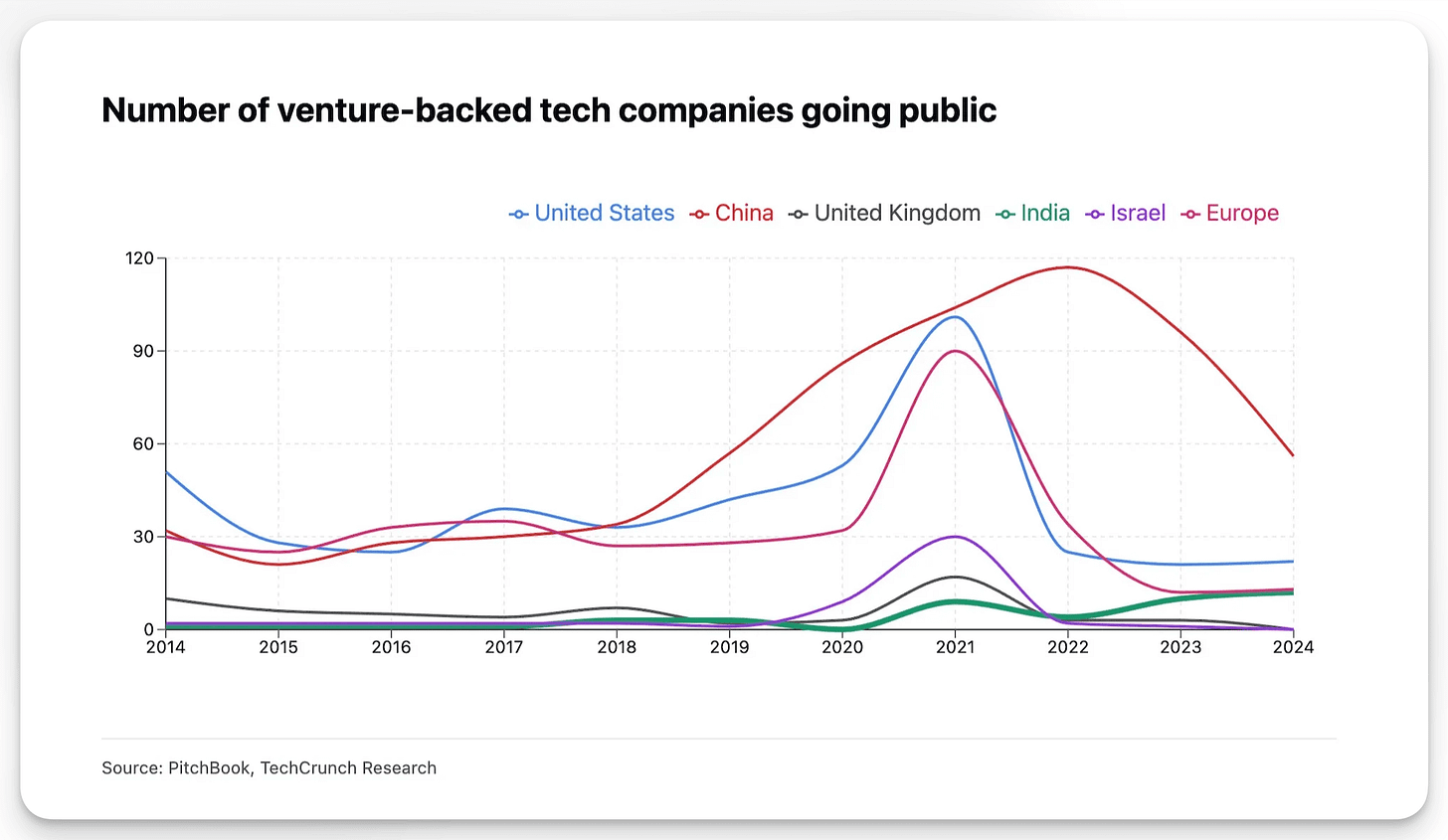

In 2024, 12 startups, including seven tech companies, have already gone public in India, making it the only major market showing consistent growth in listings over the past decade, according to Pitchbook.

This sharply contrasts with other leading markets:

The U.S. has seen 22 tech IPOs this year, nearly the same as 21 in 2023, and significantly less than 53 listings in 2020.

In China, the pace of tech company IPOs has also slowed: 56 listings this year compared to 117 in 2022.

Europe conducted only one more tech IPO than India, while the UK market remained inactive in 2024.

Analysts at Morgan Stanley write: "The IPO markets have been opening slower than we expected in March. Even having 'got fit' since 2022, many unicorns still remain unprofitable businesses."

Indian food delivery platform Swiggy conducted a $1.35 billion IPO this month, which is the largest global tech IPO this year, according to JPMorgan's analysis.

Anand Daniel, a partner at Accel, comments: "India is fast becoming a promising hub for tech IPOs driven by its strong capital markets and a thriving innovation ecosystem that continues to attract substantial investor interest."

This shift is significant for the Indian market, which has historically faced challenges regarding exit opportunities and skepticism from domestic investors about loss-making companies going public.

Abhinav Bharti, head of equity capital markets in India at JPMorgan, explains in an interview with TechCrunch: "No other country globally provides you with this much political certainty and continuity of policy."

The growth of capital markets in India is particularly noteworthy. Bharti adds: "If you look at 2019 to 2024, full-year averages, the market cap has doubled. We were at about $2.6 to $2.7 trillion dollars. We are now at $5.2 trillion to $5.3 trillion. In the same period, the daily liquidity has tripled, from $5 billion to $15 billion."

Preparation for IPOs is happening against the backdrop of a slowdown in private market deal-making. A partner at a major venture fund in India notes:

"The muted environment and additional scrutiny from VCs forced startups to let go of their peak 2021 valuations. But more interestingly, it also forced them to improve their finances. The result is that many startups in 2021 that wanted to become 'IPO ready' in 5 years are already there."

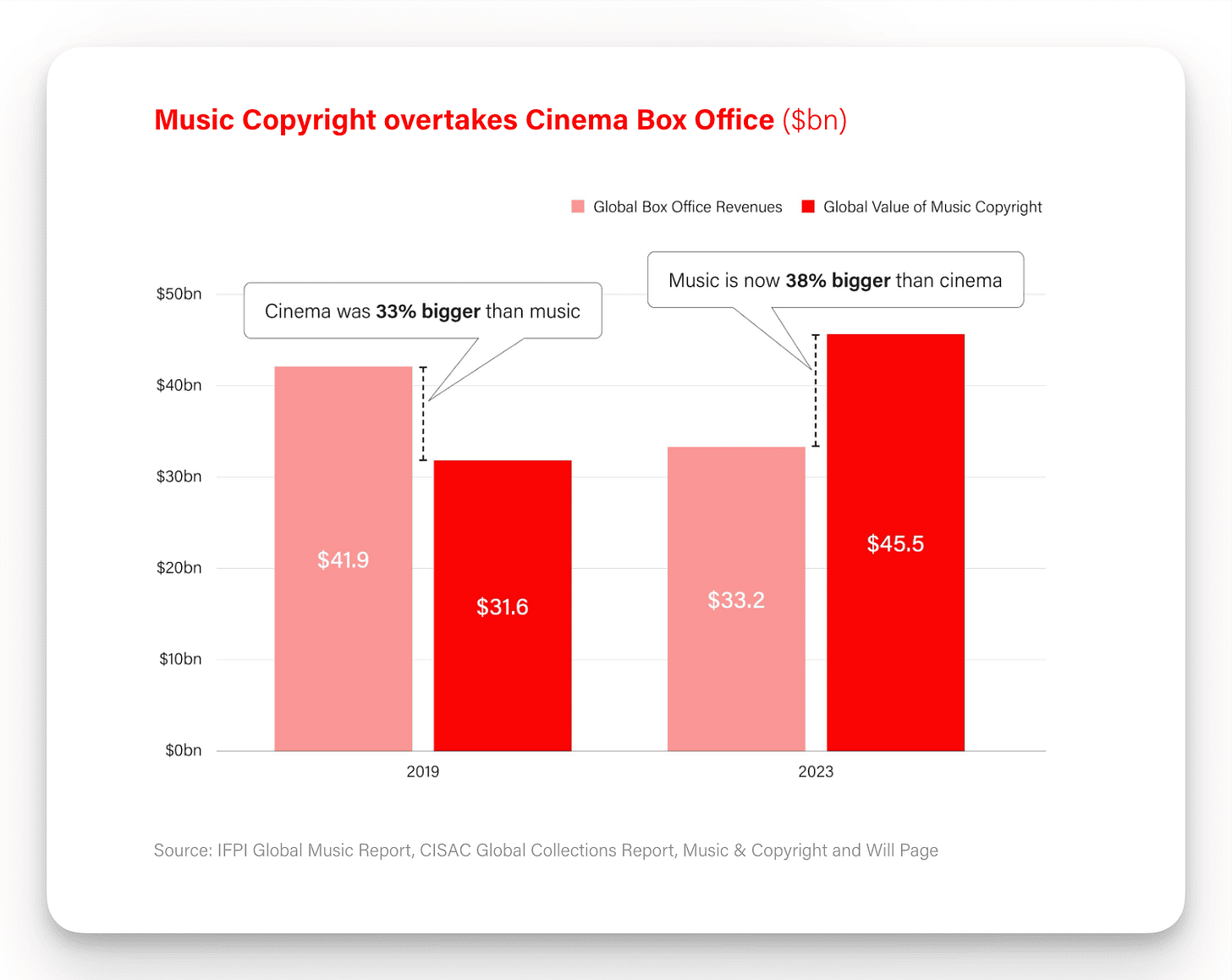

3. Data: The Global Value of Music Copyright Has Grown to $45.5 Billion

According to the latest report by Pivotal Economics, the global value of music copyright in 2023 reached $45.5 billion, now exceeding the value of cinema. This is an 11% increase compared to the previous year and an astonishing 26% since 2021, when the pandemic affected the industry.

Will Page writes:

"The global value of copyright in calendar year 2023 reached $45.5bn. That's double-digit growth (11%) year on year and a jaw-dropping 26% up since the pandemic-riddled 2021."

The breakdown of this figure:

$28.5 billion — recorded music revenues (labels).

$12.9 billion — collections by collective management organizations (CMOs).

$4.2 billion — publishers' direct income.

Page notes that labels' revenues grew by 12%, mainly due to streaming, which grew by 10.4%. But physical media are also holding up: physical sales increased by 13.4%, with vinyl up by 15.4%.

He adds:

"In the US alone, vinyl will gross labels $1bn by the end of 2024."

Demand for vinyl has always been constrained by supply, but the emergence of global players like Record Industry (Netherlands), GZ (Czech Republic), and Pressing Business (Poland) helps alleviate bottlenecks by increasing capacity and streamlining global deliveries.

Regarding revenue distribution:

63% of revenues go to artists and labels.

37% to songwriters, publishers, and their CMOs.

This distribution remains the same as last year.

These figures indicate that the music industry is experiencing a boom, affecting all market participants: from artists to publishers and labels. If you work or invest in the music business, this data can help you understand current trends and opportunities.

https://pivotaleconomics.com/undercurrents/music-copyright-2023

4. Opinion: How YouTube Is Consuming Podcasting

John Herrman, in his article for New York Magazine, examines the transformation of podcasting and how YouTube is becoming the new home for podcasts.

He notes:

"In 2024, podcasts are about as mainstream as media gets... But one shift is both underrecognized and obvious: It's not really an audio medium anymore."

According to Edison Research:

"31% of weekly podcast listeners age 13 and up choose YouTube as the service they use most to listen to podcasts, surpassing Spotify (27%) and Apple Podcasts (15%)."

This trend is more pronounced among younger listeners:

"84 percent of Gen Z monthly podcast listeners... listen to or watch podcasts with a video component."

Herrman analyzes how TikTok influenced this change. Short videos and clips from podcasts have gone viral on social media platforms, and YouTube, with its algorithms and recommendations, has become a natural place for full episodes.

He writes:

"Podcasters are still in a relatively good position to both find new audiences on social-media platforms and to meaningfully hold onto them as subscribers or paid patrons elsewhere."

However, there is a risk that dependence on platforms may make podcasters more vulnerable to changes in algorithms and policies of these platforms.

Herrman concludes:

"Podcasters will become, in material terms, more like YouTubers, TikTokers, and other influencers. They'll be working not just in a new medium, but at the mercy of the platforms."

For content creators, this means the need to adapt to new realities and find ways to maintain independence and control over their audience.

https://nymag.com/intelligencer/article/how-podcasting-became-the-new-tv.html

5. Video: How to Start a Startup with Michael Seibel

With this, we conclude today's newsletter. Remember that success comes to those who constantly learn and adapt to new challenges. Use this knowledge to stay one step ahead and build the future today. Until next time!