🐩 Investor's daily mantra, controlling your SaaS subscriptions, and Google's founder on the future of artificial intelligence

Migranotes s2e10. Seven useful materials for entrepreneurs for all days of the week

Do you remember your seed phrase?

Hi, everyone.

It's time to pour your coffee and read a selection of useful materials for startup founders and entrepreneurs. Don't forget to share useful links from it. Sharing is caring!

Here we go 🚀

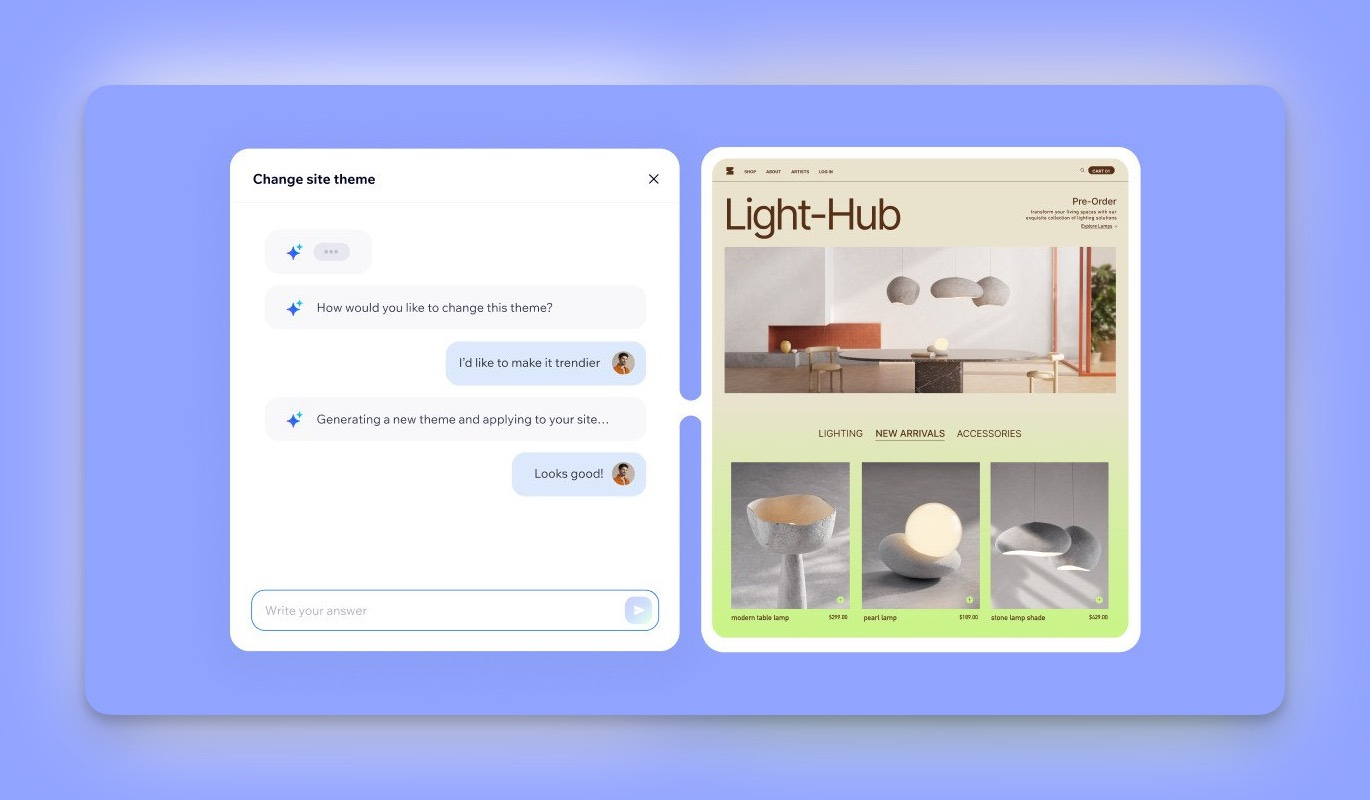

1. Productivity: AI page generator by Wix

I've seen statistics somewhere that Wix is one of the top 5 platforms for creating websites. A kind of mastodon that has been around for many years. It seemed that they missed the trend with AI landing page generation, so dozens, if not hundreds, of such services appeared.

Finally, Wix released its product. And this probably explains why they took their time. Because their generator works well. Website creation starts with a dialog with a chatbot - it asks you what your company does and sketches a simple template. And then you can change it as you wish.

https://www.wix.com/ai-website-builder

2. Report: State of Subscription Apps 2024

RevenueCat is one of the main players in the market of analytics for services with a subscription monetization model. They just released a 120-page report on the state of the market. Here are a few highlights:

1.7% of downloads converted to paid subscribers within the first 30 days, which is slightly higher than in the last report. The difference between the bottom quartile (.6%) and the top quartile (4.2%) remains stark.

The top 5% of newly launched apps generate 200 times more revenue than the bottom quartile 12 months after launch.

The average LTV per download in North America after 14 days is 4 times the global average, at $0.35 compared to $0.08. This difference exists in both the App Store and Google Play.

The share of monthly subscribers retained after 12 months fell by ~14% last year across all categories, affecting both the best and worst performers.

More than 10% of monthly subscriber churn is re-subscribing within 12 months, with even higher rates in categories such as media and entertainment.

https://www.revenuecat.com/state-of-subscription-apps-2024/

3. Startup development: Don't copy the giants' approach

Marc van Neerven warns startups against blindly copying the methods of large tech companies in their product creation and development strategies. What is good for them is often a forced reaction to the size and inertia of companies, to their legacy, which anchors simpler approaches.

Mark, in particular, says that you small companies shouldn't…

Create a bunch of microservices

Use large, bloated frameworks

Add new functionality endlessly

Develop a native mobile application

https://medium.com/cto-as-a-service/copying-big-tech-is-hurting-startups-a65e45a2cae0

4. Useful services for startups: Talisman for subscription control

Be honest, how many subscriptions does your startup have? How many SaaSs do your funds receive every month? Are you sure you can really control all these expenses? As long as there are 2-3 such subscriptions, everything is fine, but suddenly there are two dozen of them. And one day you receive a "happiness letter" informing you that XXX service has just charged you a bunch of money for an annual plan. And you haven't used it for a long time!

Talisman promises to put you in control of the situation. The paid plan (a subscription, of course) starts at $300 per month. And you're thinking: maybe I'm not losing so much from lack of control? ☺️ But that's just a joke, because with the free plan, you can monitor up to 30 subscriptions and connect up to 5 bank accounts. at the start, this will definitely be enough for you!

5. Relationships with VCs: the daily mantra of investors

Nikhil Basu Trivedi, General Partner at Footwork, summarizes the role of a venture capitalist perfectly in his daily mantra: Find, Decide, Win, Help, Exit.

These five parts of the job were first explained to Nikhil by his mentor at Shasta Ventures, Todd Francis, through a simple flowchart that Nikhil scribbled on a Virgin America napkin during a cross-country flight in 2014.

Find: Finding the best companies to invest in

Decide: Deciding which companies to invest in, taking into account the firm's investment strategy

Win: Winning deals by being the preferred choice for founders

Help: Helping companies succeed by supporting them after the investment

Exit: Preparing for a successful exit, maximizing the return on investment

What is your investor's strength?

6. Video: Sergey Brin about AGI, Gemini and other Google initiatives

7. Opinion: Mira Murati, OpenAI service station, on the end(?) of the corporate conflict

Governance of an institution is critical for oversight, stability, and continuity. I am happy that the independent review has concluded and we can all move forward united.

It has been disheartening to witness the previous board’s efforts to scapegoat me with anonymous and misleading claims in a last-ditch effort to save face in the media. Here is the message I sent to my team last night.

Onward.